too larry

Well-Known Member

Hey guys. I don't play in these waters often, but I did wonder what you guys think of the loss of deductions. I'm from Florida where we do not have a state income tax, but fund our state government with a high sales tax, as well as fees on every little thing. County government {schools, roads, Law Enforcement, Sr Cit Orgs, etc, etc} is funded by a mix of property tax and add on sales taxes. Where I am in Florida, taxes are relatively low. But we have a low level of funding for all of the above.

High taxes, both income and property, pay for the denser based infrastructure of the coasts. More folks mean more roads, schools, hospitals, etc, etc. That is what is needed, and what they decided to do with their money.

Most of the GOP tax cuts will go to the very richest, and I'm not a big fan of that. But I really would not mind seeing all the deductions for local taxes removed. Not sure what the numbers are {I did no research before posting this thread}, but I'm guessing it adds up to serious money. Going from the poorer sections of the county to the wealthier coasts.

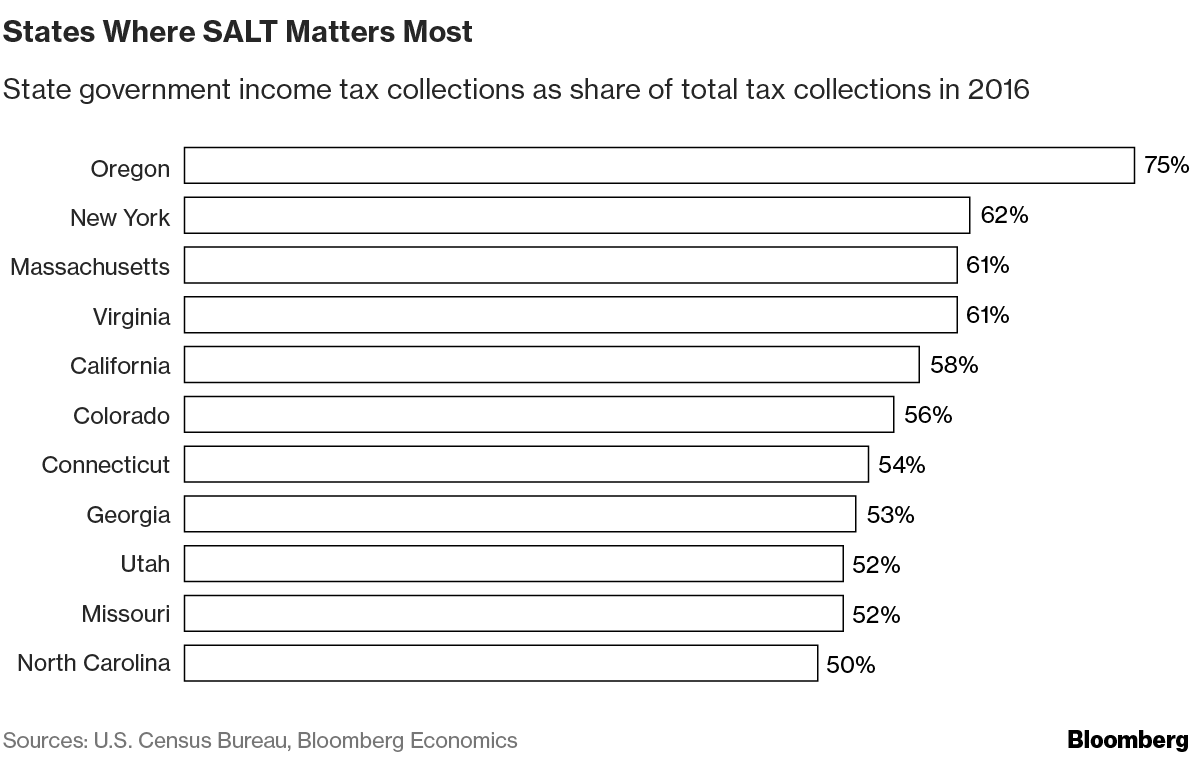

I'm guess most will have a geographical based opinion. Folks out in the sticks, like me, don't see why we have to give folks in Northeastern and West Coast cities and suburbs a break on taxes their own people decided to impose.

What say you?

High taxes, both income and property, pay for the denser based infrastructure of the coasts. More folks mean more roads, schools, hospitals, etc, etc. That is what is needed, and what they decided to do with their money.

Most of the GOP tax cuts will go to the very richest, and I'm not a big fan of that. But I really would not mind seeing all the deductions for local taxes removed. Not sure what the numbers are {I did no research before posting this thread}, but I'm guessing it adds up to serious money. Going from the poorer sections of the county to the wealthier coasts.

I'm guess most will have a geographical based opinion. Folks out in the sticks, like me, don't see why we have to give folks in Northeastern and West Coast cities and suburbs a break on taxes their own people decided to impose.

What say you?