Do You Support The "Occupy"Protests?

- Thread starter Tales

- Start date

Brick Top

New Member

They are insane, they do not have a clue what some of what they want would do to the nation. For example ... here is one of their proposed demands.

CONGRESS PASS THE BUFFETT RULE ON FAIR TAXATION SO THE RICH AND CORPORATIONS PAY THEIR FAIR SHARE & CLOSE CORPORATE TAX LOOP HOLES AND ENACT A PROHIBITION ON HIDING FUNDS OFF SHORE. No more GE paying zero or negative taxes. Pass the Buffet Rule on fair taxation so the rich pay their fair share. (If we have a really had a good negotiating position and have the place surrounded, we could actually dial up taxes on millionaires, billionaires and corporations even higher...back to what they once were in the 50's and 60's.

In 2010 the top 1% wage earners paid 38% of all federally collected tax revenues. In case anyone missed that, just the top 1% wage earners alone paid 38% of all collected federal tax revenues. What would be unfair would be to force them to pay an even larger percentage of all federally collected tax revenues.

The top 5% of wage earners paid 58.72% of all federally collected tax revenues. Just 5% of all wage earners paid over half of all federally collected tax revenues. Isn't that a bit unfair? Wouldn't it be even more unfair to force the top 5% of wage earners to pay even more?

The top 10% of wage earners paid 69.94% of all federally collected tax revenues. Still the Occupy Wall Street morons do not believe the upper level wage earners are paying their "fair share" of taxes.

The top 25% of wage earners paid 86.34% of all collected federal tax revenues. The fourth of wage earners paid 86.34% of all collected federal tax revenues. Still the Occupy Wall Street imbeciles believe the upper income wage earners are not paying their "fair share."

The bottom 50% of wage earners paid a whopping grand total of 12.75% of all collected federal tax revenues. That was just 12.75% coming from half the wage earners in the U.S.

How in the wide wide world of sports can it be "fair" to tax upper income earners at an even higher percentage than they are already paying?

Recently I read an interesting statistic. If every single dollar was taken from every single billionaire and millionaire in the United States and given to the government it would not fund the government for six months.

In the past the highest tax rates for upper income earners were 70 to 91 percent. The Occupy Wall Street clowns want to bring that back. But you do not hear them say that they also want to bring back the MASSIVE number of totally legal deductions that were allowed then that by the time an upper income wage earner's tax accountant was done figuring them all greatly reduced the amount that was owed resulting in paying an amount that would be a much lower percentage of income.

It has been proven that lowering taxation results in increased tax revenues being collected.

And what happened?

Kennedy said:

So let’s move on to Ronald Reagan. Reagan had two major tax cutting policies implemented: the Economic Recovery Tax Act (ERTA) of 1981, which was retroactive to 1981, and the Tax Reform Act of 1986.

Did Reagan’s tax cuts decrease federal revenues? Hardly:

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a MASSIVE INCREASE of revenue.

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a MASSIVE INCREASE of revenue.

So Reagan’s tax cuts increased revenue. But who paid the increased tax revenue? The poor? Opponents of the Reagan tax cuts argued that his policy was a giveaway to the rich (ever heard that one before?) because their tax payments would fall. But that was exactly wrong. In reality:

Let’s move on to George Bush and the infamous (to Democrats) Bush tax cuts. And let me quote none other than the New York Times:

Note the newspaper’s use of liberals favorite adjective: “unexpected.” They never expect Republican and conservative polices to work, but they always do if they’re given the chance. They never expect Democrat and liberal policies to fail, but they always seem to fail every single time they’re tried.

For the record, President George Bush’s 2003 tax cuts:

As a result of the Clinton-era Dot-com bubble bursting, the Nasdaq lost a whopping 78% of its value, and $6 trillion dollars of wealth was simply vaporized. We don’t tend to remember how bad that economic disaster was, because the 9/11 attack was such a huge experience, and because instead of endlessly blaming his predecessor, George Bush simply took responsibility for the economy, cut taxes, and fixed the problem. The result, besides the above tax revenue gains, was an incredible and unprecedented 52 consecutive months of job growth.

Update September 12: Did somebody say something about “jobs”? Another fact to recognize is the horrendous damage that will be done to small businesses and the jobs they create if the tax cuts for the “rich” aren’t continued. As found in the Wall Street Journal, “According to IRS data, fully 48% of the net income of sole proprietorships, partnerships, and S corporations reported on tax returns went to households with incomes above $200,000 in 2007.” Further, the Tax Policy Center found that basically a third of taxpayers who are expected to be in the top tax bracket in 2011 generate more than half their income from a business ownership. And while Democrats love to point out that their tax hikes on the so-called rich only impact 3% of small businesses, the National Federation of Independent Business reports that that three percent employs about 25 percent of the nation’s total workforce. “Small businesses that employ 20 to 250 workers are the most likely to be hit by an increase in the top two tax rates, according to NFIB research. Businesses of this size employ more than 25 percent of the U.S. workforce.” So if you want jobs and an economic recovery, you simply don’t pile more punishing taxes on those “rich” people. Especially during a recession [End update].

We’re not arguing theories here; we’re talking about the actual, empirical numbers, literally dollars and cents, which confirms Andrew Mellon’s thesis, and Warren Harding’s and Calvin Coolidge’s, John F. Kennedy’s, Ronald Reagan’s, and George W. Bush’s, economic policies.

Harding and Coolidge, Reagan and Bush, with Democrat JFK right smack in the middle: great tax cutters all.

The notion that small- and limited-government conservatives who want ALL Americans to pay less to a freedom-encroaching government are somehow “beholden to the rich” for doing so is just a lie. And a Marxist-based lie at that.

[Update, 12/15/10]: Check out these numbers as to how the Reagan tax cuts INCREASED the taxes paid by the wealthy, and REDUCED the taxes paid by the middle class and the bottom 50% of tax payers:

Income tax burdens (from the Joint Economic Committee for the US Congress report, 1996):

1981: top 1% of earners paid 17.6% of all personal income taxes

1988: top 1% of earners paid 27.5% of all personal income taxes (+ 10%).

1981: top 10% of earners paid 48% of all personal income taxes

1988: top 10% of earners paid 57.2% of all personal income taxes (+ 9%).

So rich clearly paid MORE of the tax burden when their tax rates were LOWERED.

For the middle class:

1981: middle class paid 57.5% of all personal income taxes

1988: middle class paid 48.7% of all personal income taxes (- 9%).

The middle class’ tax burden went DOWN by 9%. They paid almost 10% LESS than what they had been paying before the Reagan cuts.

For the bottom 50%:

1981: bottom 50% paid 7.5% of all personal income taxes

1988: bottom 50% paid 5.7% of all personal income taxes (- 2%).

So the Joint Economic Economic Committee concludes that if you lower the tax rates on the rich, the rich wind up paying MORE of the tax burden and the poor end up paying LESS. When you enact confiscatory taxation policies, the people who can afford it invariably end up protecting their money. They do everything they can to NOT pay taxes because they are getting screwed. When the rates drop to reasonable rates, they don’t shelter their money; rather, they take advantage of their ability to earn more – and improve the economy by doing so – by investing. If you take away their profit, you take away their incentive to improve the economy and create jobs.

Lower tax rates do not mean less tax revenue. It equates to increased tax revenues collected. That is something the Occupy Wall Street idiots do not understand. Raising taxes on the wealthy alters how they invest, they shift their investment capital to investments that will not be taxed at as high of a rate or not be taxed at all. Capital is drained from the economy and businesses suffer from a cash shortage and cannot expand and hire, profits become stagnant so to increase profits business cuts spending, which means laying off employees. Both loss of increased profits and the loss of paychecks further reduces the amount of collected tax revenues.

Depending on the rate of return investors will at times shift their investment capital to tax free guaranteed government bonds. The rate of return is always lower than other investments but the net profit can be higher because the other investments are taxable and the bonds are tax free. Each government bond purchased adds to the national debt since it is in essence a loan to the government that the government has to pay back, with interest.

The Occupy Wall Street people, and those who support them, do not understand taxation, they do not understand economics and they do not understand the wealthy, nor do do they understand the immense importance the wealthy are to the nation and how important it is to create an economic climate where the wealthy will readily invest in business and become even wealthier so they can then invest even more in the economy.

Some of Occupy Wall Street's proposed demands are decent, maybe even good and maybe even needed. But when it comes to taxation they have their heads jammed so far up their own asses that they can look out of their mouths.

CONGRESS PASS THE BUFFETT RULE ON FAIR TAXATION SO THE RICH AND CORPORATIONS PAY THEIR FAIR SHARE & CLOSE CORPORATE TAX LOOP HOLES AND ENACT A PROHIBITION ON HIDING FUNDS OFF SHORE. No more GE paying zero or negative taxes. Pass the Buffet Rule on fair taxation so the rich pay their fair share. (If we have a really had a good negotiating position and have the place surrounded, we could actually dial up taxes on millionaires, billionaires and corporations even higher...back to what they once were in the 50's and 60's.

In 2010 the top 1% wage earners paid 38% of all federally collected tax revenues. In case anyone missed that, just the top 1% wage earners alone paid 38% of all collected federal tax revenues. What would be unfair would be to force them to pay an even larger percentage of all federally collected tax revenues.

The top 5% of wage earners paid 58.72% of all federally collected tax revenues. Just 5% of all wage earners paid over half of all federally collected tax revenues. Isn't that a bit unfair? Wouldn't it be even more unfair to force the top 5% of wage earners to pay even more?

The top 10% of wage earners paid 69.94% of all federally collected tax revenues. Still the Occupy Wall Street morons do not believe the upper level wage earners are paying their "fair share" of taxes.

The top 25% of wage earners paid 86.34% of all collected federal tax revenues. The fourth of wage earners paid 86.34% of all collected federal tax revenues. Still the Occupy Wall Street imbeciles believe the upper income wage earners are not paying their "fair share."

The bottom 50% of wage earners paid a whopping grand total of 12.75% of all collected federal tax revenues. That was just 12.75% coming from half the wage earners in the U.S.

How in the wide wide world of sports can it be "fair" to tax upper income earners at an even higher percentage than they are already paying?

Recently I read an interesting statistic. If every single dollar was taken from every single billionaire and millionaire in the United States and given to the government it would not fund the government for six months.

In the past the highest tax rates for upper income earners were 70 to 91 percent. The Occupy Wall Street clowns want to bring that back. But you do not hear them say that they also want to bring back the MASSIVE number of totally legal deductions that were allowed then that by the time an upper income wage earner's tax accountant was done figuring them all greatly reduced the amount that was owed resulting in paying an amount that would be a much lower percentage of income.

It has been proven that lowering taxation results in increased tax revenues being collected.

In 1921, President Harding asked the sixty-five-year-old [Andrew] Mellon to be secretary of the treasury; the national debt [resulting from WWI] had surpassed $20 billion and unemployment had reached 11.7 percent, one of the highest rates in U.S. history. Harding invited Mellon to tinker with tax rates to encourage investment without incurring more debt. Mellon studied the problem carefully; his solution was what is today called “supply side economics,” the idea of cutting taxes to stimulate investment. High income tax rates, Mellon argued, “inevitably put pressure upon the taxpayer to withdraw this capital from productive business and invest it in tax-exempt securities. . . . The result is that the sources of taxation are drying up, wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people” (page 128).

Mellon wrote, “It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower taxes.” And he compared the government setting tax rates on incomes to a businessman setting prices on products: “If a price is fixed too high, sales drop off and with them profits.”

And what happened?

“As secretary of the treasury, Mellon promoted, and Harding and Coolidge backed, a plan that eventually cut taxes on large incomes from 73 to 24 percent and on smaller incomes from 4 to 1/2 of 1 percent. These tax cuts helped produce an outpouring of economic development – from air conditioning to refrigerators to zippers, Scotch tape to radios and talking movies. Investors took more risks when they were allowed to keep more of their gains. President Coolidge, during his six years in office, averaged only 3.3 percent unemployment and 1 percent inflation – the lowest misery index of any president in the twentieth century.

Furthermore, Mellon was also vindicated in his astonishing predictions that cutting taxes across the board would generate more revenue. In the early 1920s, when the highest tax rate was 73 percent, the total income tax revenue to the U.S. government was a little over $700 million. In 1928 and 1929, when the top tax rate was slashed to 25 and 24 percent, the total revenue topped the $1 billion mark. Also remarkable, as Table 3 indicates, is that the burden of paying these taxes fell increasingly upon the wealthy” (page 129-130).

Furthermore, Mellon was also vindicated in his astonishing predictions that cutting taxes across the board would generate more revenue. In the early 1920s, when the highest tax rate was 73 percent, the total income tax revenue to the U.S. government was a little over $700 million. In 1928 and 1929, when the top tax rate was slashed to 25 and 24 percent, the total revenue topped the $1 billion mark. Also remarkable, as Table 3 indicates, is that the burden of paying these taxes fell increasingly upon the wealthy” (page 129-130).

Kennedy said:

“It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now … Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.”

– John F. Kennedy, Nov. 20, 1962, president’s news conference

“Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased – not a reduced – flow of revenues to the federal government.”

– John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964

“In today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit – why reducing taxes is the best way open to us to increase revenues.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“It is no contradiction – the most important single thing we can do to stimulate investment in today’s economy is to raise consumption by major reduction of individual income tax rates.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort – thereby aborting our recoveries and stifling our national growth rate.”

– John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session.

“A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues.”

– John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill

Which is to say that modern Democrats are essentially calling one of their greatest presidents a liar when they demonize tax cuts as a means of increasing government revenues.– John F. Kennedy, Nov. 20, 1962, president’s news conference

“Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased – not a reduced – flow of revenues to the federal government.”

– John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964

“In today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit – why reducing taxes is the best way open to us to increase revenues.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“It is no contradiction – the most important single thing we can do to stimulate investment in today’s economy is to raise consumption by major reduction of individual income tax rates.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort – thereby aborting our recoveries and stifling our national growth rate.”

– John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session.

“A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues.”

– John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill

So let’s move on to Ronald Reagan. Reagan had two major tax cutting policies implemented: the Economic Recovery Tax Act (ERTA) of 1981, which was retroactive to 1981, and the Tax Reform Act of 1986.

Did Reagan’s tax cuts decrease federal revenues? Hardly:

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a MASSIVE INCREASE of revenue.

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a MASSIVE INCREASE of revenue.So Reagan’s tax cuts increased revenue. But who paid the increased tax revenue? The poor? Opponents of the Reagan tax cuts argued that his policy was a giveaway to the rich (ever heard that one before?) because their tax payments would fall. But that was exactly wrong. In reality:

“The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.”

So Ronald Reagan a) collected more total revenue, b) collected more revenue from the rich, while c) reducing revenue collected by the bottom half of taxpayers, and d) generated an economic powerhouse that lasted – with only minor hiccups – for nearly three decades. Pretty good achievement considering that his predecessor was forced to describe his own economy as a “malaise,” suffering due to a “crisis of confidence.” Pretty good considering that President Jimmy Carter responded to a reporter’s question as to what he would do about the problem of inflation by answering, “It would be misleading for me to tell any of you that there is a solution to it.”

Let’s move on to George Bush and the infamous (to Democrats) Bush tax cuts. And let me quote none other than the New York Times:

WASHINGTON, July 12 – For the first time since President Bush took office, an unexpected leap in tax revenue is about to shrink the federal budget deficit this year, by nearly $100 billion.

A Jump in Corporate Payments On Wednesday, White House officials plan to announce that the deficit for the 2005 fiscal year, which ends in September, will be far smaller than the $427 billion they estimated in February.

Mr. Bush plans to hail the improvement at a cabinet meeting and to cite it as validation of his argument that tax cuts would stimulate the economy and ultimately help pay for themselves.

Based on revenue and spending data through June, the budget deficit for the first nine months of the fiscal year was $251 billion, $76 billion lower than the $327 billion gap recorded at the corresponding point a year earlier.

The Congressional Budget Office estimated last week that the deficit for the full fiscal year, which reached $412 billion in 2004, could be “significantly less than $350 billion, perhaps below $325 billion.”

The big surprise has been in tax revenue, which is running nearly 15 percent higher than in 2004. Corporate tax revenue has soared about 40 percent, after languishing for four years, and individual tax revenue is up as well.

[Update, September 20: The above NY Times link was scrubbed; the same article, edited differently, appears here.]A Jump in Corporate Payments On Wednesday, White House officials plan to announce that the deficit for the 2005 fiscal year, which ends in September, will be far smaller than the $427 billion they estimated in February.

Mr. Bush plans to hail the improvement at a cabinet meeting and to cite it as validation of his argument that tax cuts would stimulate the economy and ultimately help pay for themselves.

Based on revenue and spending data through June, the budget deficit for the first nine months of the fiscal year was $251 billion, $76 billion lower than the $327 billion gap recorded at the corresponding point a year earlier.

The Congressional Budget Office estimated last week that the deficit for the full fiscal year, which reached $412 billion in 2004, could be “significantly less than $350 billion, perhaps below $325 billion.”

The big surprise has been in tax revenue, which is running nearly 15 percent higher than in 2004. Corporate tax revenue has soared about 40 percent, after languishing for four years, and individual tax revenue is up as well.

Note the newspaper’s use of liberals favorite adjective: “unexpected.” They never expect Republican and conservative polices to work, but they always do if they’re given the chance. They never expect Democrat and liberal policies to fail, but they always seem to fail every single time they’re tried.

For the record, President George Bush’s 2003 tax cuts:

raised federal tax receipts by $785 billion, the largest four-year revenue increase in U.S. history. In fiscal 2007, which ended last month, the government took in 6.7% more tax revenues than in 2006.

These increases in tax revenue have substantially reduced the federal budget deficits. In 2004 the deficit was $413 billion, or 3.5% of gross domestic product. It narrowed to $318 billion in 2005, $248 billion in 2006 and $163 billion in 2007. That last figure is just 1.2% of GDP, which is half of the average of the past 50 years.

Lower tax rates have be so successful in spurring growth that the percentage of federal income taxes paid by the very wealthy has increased. According to the Treasury Department, the top 1% of income tax filers paid just 19% of income taxes in 1980 (when the top tax rate was 70%), and 36% in 2003, the year the Bush tax cuts took effect (when the top rate became 35%). The top 5% of income taxpayers went from 37% of taxes paid to 56%, and the top 10% from 49% to 68% of taxes paid. And the amount of taxes paid by those earning more than $1 million a year rose to $236 billion in 2005 from $132 billion in 2003, a 78% increase.

Budget deficits are not merely a matter of tax policy; it is a matter of tax policy AND spending policy. Imagine you have a minimum wage job, but live within your means. Then you get a job that pays a million dollars a year. And you go a little nuts, buy a mansion, a yacht, a fancy car, and other assorted big ticket items such that you go into debt. Are you really so asinine as to argue that you made more money when you earned minimum wage? But that’s literally the Democrats’ argument when they criticize Reagan (who defeated the Soviet Union and won the Cold War in the aftermath of a recession he inherited from President Carter) and George Bush (who won the Iraq War after suffering the greatest attack on US soil in the midst of a recession he inherited from President Clinton).These increases in tax revenue have substantially reduced the federal budget deficits. In 2004 the deficit was $413 billion, or 3.5% of gross domestic product. It narrowed to $318 billion in 2005, $248 billion in 2006 and $163 billion in 2007. That last figure is just 1.2% of GDP, which is half of the average of the past 50 years.

Lower tax rates have be so successful in spurring growth that the percentage of federal income taxes paid by the very wealthy has increased. According to the Treasury Department, the top 1% of income tax filers paid just 19% of income taxes in 1980 (when the top tax rate was 70%), and 36% in 2003, the year the Bush tax cuts took effect (when the top rate became 35%). The top 5% of income taxpayers went from 37% of taxes paid to 56%, and the top 10% from 49% to 68% of taxes paid. And the amount of taxes paid by those earning more than $1 million a year rose to $236 billion in 2005 from $132 billion in 2003, a 78% increase.

As a result of the Clinton-era Dot-com bubble bursting, the Nasdaq lost a whopping 78% of its value, and $6 trillion dollars of wealth was simply vaporized. We don’t tend to remember how bad that economic disaster was, because the 9/11 attack was such a huge experience, and because instead of endlessly blaming his predecessor, George Bush simply took responsibility for the economy, cut taxes, and fixed the problem. The result, besides the above tax revenue gains, was an incredible and unprecedented 52 consecutive months of job growth.

Update September 12: Did somebody say something about “jobs”? Another fact to recognize is the horrendous damage that will be done to small businesses and the jobs they create if the tax cuts for the “rich” aren’t continued. As found in the Wall Street Journal, “According to IRS data, fully 48% of the net income of sole proprietorships, partnerships, and S corporations reported on tax returns went to households with incomes above $200,000 in 2007.” Further, the Tax Policy Center found that basically a third of taxpayers who are expected to be in the top tax bracket in 2011 generate more than half their income from a business ownership. And while Democrats love to point out that their tax hikes on the so-called rich only impact 3% of small businesses, the National Federation of Independent Business reports that that three percent employs about 25 percent of the nation’s total workforce. “Small businesses that employ 20 to 250 workers are the most likely to be hit by an increase in the top two tax rates, according to NFIB research. Businesses of this size employ more than 25 percent of the U.S. workforce.” So if you want jobs and an economic recovery, you simply don’t pile more punishing taxes on those “rich” people. Especially during a recession [End update].

We’re not arguing theories here; we’re talking about the actual, empirical numbers, literally dollars and cents, which confirms Andrew Mellon’s thesis, and Warren Harding’s and Calvin Coolidge’s, John F. Kennedy’s, Ronald Reagan’s, and George W. Bush’s, economic policies.

Harding and Coolidge, Reagan and Bush, with Democrat JFK right smack in the middle: great tax cutters all.

The notion that small- and limited-government conservatives who want ALL Americans to pay less to a freedom-encroaching government are somehow “beholden to the rich” for doing so is just a lie. And a Marxist-based lie at that.

[Update, 12/15/10]: Check out these numbers as to how the Reagan tax cuts INCREASED the taxes paid by the wealthy, and REDUCED the taxes paid by the middle class and the bottom 50% of tax payers:

Income tax burdens (from the Joint Economic Committee for the US Congress report, 1996):

1981: top 1% of earners paid 17.6% of all personal income taxes

1988: top 1% of earners paid 27.5% of all personal income taxes (+ 10%).

1981: top 10% of earners paid 48% of all personal income taxes

1988: top 10% of earners paid 57.2% of all personal income taxes (+ 9%).

So rich clearly paid MORE of the tax burden when their tax rates were LOWERED.

For the middle class:

1981: middle class paid 57.5% of all personal income taxes

1988: middle class paid 48.7% of all personal income taxes (- 9%).

The middle class’ tax burden went DOWN by 9%. They paid almost 10% LESS than what they had been paying before the Reagan cuts.

For the bottom 50%:

1981: bottom 50% paid 7.5% of all personal income taxes

1988: bottom 50% paid 5.7% of all personal income taxes (- 2%).

So the Joint Economic Economic Committee concludes that if you lower the tax rates on the rich, the rich wind up paying MORE of the tax burden and the poor end up paying LESS. When you enact confiscatory taxation policies, the people who can afford it invariably end up protecting their money. They do everything they can to NOT pay taxes because they are getting screwed. When the rates drop to reasonable rates, they don’t shelter their money; rather, they take advantage of their ability to earn more – and improve the economy by doing so – by investing. If you take away their profit, you take away their incentive to improve the economy and create jobs.

Lower tax rates do not mean less tax revenue. It equates to increased tax revenues collected. That is something the Occupy Wall Street idiots do not understand. Raising taxes on the wealthy alters how they invest, they shift their investment capital to investments that will not be taxed at as high of a rate or not be taxed at all. Capital is drained from the economy and businesses suffer from a cash shortage and cannot expand and hire, profits become stagnant so to increase profits business cuts spending, which means laying off employees. Both loss of increased profits and the loss of paychecks further reduces the amount of collected tax revenues.

Depending on the rate of return investors will at times shift their investment capital to tax free guaranteed government bonds. The rate of return is always lower than other investments but the net profit can be higher because the other investments are taxable and the bonds are tax free. Each government bond purchased adds to the national debt since it is in essence a loan to the government that the government has to pay back, with interest.

The Occupy Wall Street people, and those who support them, do not understand taxation, they do not understand economics and they do not understand the wealthy, nor do do they understand the immense importance the wealthy are to the nation and how important it is to create an economic climate where the wealthy will readily invest in business and become even wealthier so they can then invest even more in the economy.

Some of Occupy Wall Street's proposed demands are decent, maybe even good and maybe even needed. But when it comes to taxation they have their heads jammed so far up their own asses that they can look out of their mouths.

colocowboy

Well-Known Member

Surprise that you have that opinion. Were you one of the cops at Kent State or what?!They are insane, they do not have a clue what some of what they want would do to the nation.

mame

Well-Known Member

Brick Top, you dont spend much time in this section do you? I ask because your copy/paste is full of misleading statistics that we've already gone through on these boards at least a dozen times. I'll pick a few out real quick...

No, it has not been proven. Sure, if I cut taxes I might be bringing in more revenue 10 years from now but once you take into account population and inflation among other factors you really aren't bringing in any extra money. In fact, the Bush tax cuts have cost an estimated $2 TRILLION in one decade - there was no broadening of the base that took place. I see you invoke Reagan?

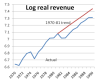

What this shows, is exactly what I mean. Sure, revenues are up - but they're always up. Reagan lowered rates, but it didn't change the trend at all. EVERYTHING between the red and blue line means LOST revenue compared to if there were no tax breaks in 81/86. So no, it is not fact that reducing rates "broadens the base"... It doesn't change the trend at all. Frankly, if you knew anything about economics and tax policy as you seem to be claiming you'd know this. You know what else you'd know? That tax policy is not really that important in the big scheme of things when compared to the Federal Reserve. Above all else lies the influence of the Fed and it's use of monetary policy... and if you paid attention to the Reagan economy at all you'd know that Fed chairman Volcker was behind "morning in America" - not Reagan(to be fair, Clinton had little to do with good economic times during his term as well).

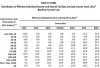

Really, if you want a solid look at our tax system this is what you should be looking at - effective income and payroll tax rates by bracket:

As you can see, the tax system is indeed mostly progressive as designed. The only two parts of the chart that anyone ever has a beef with is the top left and bottom left - the poorest and the richest in the nation. The very poor, as you can see, often pay no taxes at all and many recieve more than they put into the system - and that's by design... It's a progressive tax system after all. The bottom left, however, shows that the top 10 percent of millionaires are paying 4.2% or less and the top 25% of millionaires are paying 12.6% ot less. How is THAT fair when the median tax rate on those making 40-50k a year is 13.1%? That means that at the same time 25% of millionaires are paying 12.6% or less, 50% of median wage earners (which is ~40k per year) are paying MORE than 13.1%. Is that fair? The Buffet rule is actually an excellent idea because it fixes this problem. Like I said, the system is supposed to be progressive.

also, random bolding of posts is pretty annoying i wish it'd stop doing that.

Okay. It's obvious you dont realize how wealth is distrubuted, because you're essentially complaining about a non-issue right now. The top 1% pay that much in taxes because THEY OWN ALL OF THE WEALTH. In fact, as of 2007 the net worth of the top 1% amounts to 34.7% of ALL WEALTH IN THE U.S.. This goes down the line with the next 19%(the top 20% minus the top 1%) owning 50.5% of the wealth. The bottom 80% make up only 15% of our nations total wealth! So tell me, how is it unfair that a group that owns nearly 35% of the wealth pays 38% of all federal taxes? Sounds pretty fair to me.In 2010 the top 1% wage earners paid 38% of all federally collected tax revenues.

It has been proven that lowering taxation results in increased tax revenues being collected.

No, it has not been proven. Sure, if I cut taxes I might be bringing in more revenue 10 years from now but once you take into account population and inflation among other factors you really aren't bringing in any extra money. In fact, the Bush tax cuts have cost an estimated $2 TRILLION in one decade - there was no broadening of the base that took place. I see you invoke Reagan?

What this shows, is exactly what I mean. Sure, revenues are up - but they're always up. Reagan lowered rates, but it didn't change the trend at all. EVERYTHING between the red and blue line means LOST revenue compared to if there were no tax breaks in 81/86. So no, it is not fact that reducing rates "broadens the base"... It doesn't change the trend at all. Frankly, if you knew anything about economics and tax policy as you seem to be claiming you'd know this. You know what else you'd know? That tax policy is not really that important in the big scheme of things when compared to the Federal Reserve. Above all else lies the influence of the Fed and it's use of monetary policy... and if you paid attention to the Reagan economy at all you'd know that Fed chairman Volcker was behind "morning in America" - not Reagan(to be fair, Clinton had little to do with good economic times during his term as well).

Really, if you want a solid look at our tax system this is what you should be looking at - effective income and payroll tax rates by bracket:

As you can see, the tax system is indeed mostly progressive as designed. The only two parts of the chart that anyone ever has a beef with is the top left and bottom left - the poorest and the richest in the nation. The very poor, as you can see, often pay no taxes at all and many recieve more than they put into the system - and that's by design... It's a progressive tax system after all. The bottom left, however, shows that the top 10 percent of millionaires are paying 4.2% or less and the top 25% of millionaires are paying 12.6% ot less. How is THAT fair when the median tax rate on those making 40-50k a year is 13.1%? That means that at the same time 25% of millionaires are paying 12.6% or less, 50% of median wage earners (which is ~40k per year) are paying MORE than 13.1%. Is that fair? The Buffet rule is actually an excellent idea because it fixes this problem. Like I said, the system is supposed to be progressive.

also, random bolding of posts is pretty annoying i wish it'd stop doing that.

sync0s

Well-Known Member

To be honest, I haven't been able to grasp a singular reason for the protests, so I can't out right say no. However, through most of what I have heard, I feel that the protestors are protesting the wrong people. It is the greed in our government that not only causes but enables the big banks and corporations to act the way they do. Banks and corporations are like a little chubby kid who loves cookies. Our government is the adult who decided to take the cookie jar out of the cupboard and put it on the kitchen table so the chubby kid can reach them whenever they want. Yeah....

Brick Top

New Member

No I don't.Brick Top, you dont spend much time in this section do you?

No, they are factual. The information is actual IRS numbers. But they are numbers that uber-liberals always reject and do their very best to distort and propagandize so they appear different than they are.I ask because your copy/paste is full of misleading statistics

It's obvious you dont realize how wealth is distrubuted

I have somewhat of a grasp of the subject of wealth, not massive wealth like Bill Gates, but a more than just respectable amount. Having been the owner of three successful businesses and being able to retire at 49-years old has given me something of an insight that many here who have never achieved anything near to that can only imagine and parrot the claims of others who they like to believe know what they are talking about.

I am unsure where your numbers came from but they are highly inaccurate.In fact, as of 2007 the net worth of the top 1% amounts to 34.7% of ALL WEALTH IN THE U.S.. This goes down the line with the next 19%(the top 20% minus the top 1%) owning [/B]50.5% of the wealth. The bottom 80% make up only 15% of our nations total wealth[/B]! So tell me, how is it unfair that a group that owns nearly 35% of the wealth pays 38% of all federal taxes? Sounds pretty fair to me.

Tax Year 2008

Percentiles Ranked by AGI

AGI Threshold on Percentiles

Percentage of Federal Personal Income Tax Paid

Top 1%

$380,354

38.02

Top 5%

$159,619

58.72

Top 10%

$113,799

69.94

Top 25%

$67,280

86.34

Top 50%

$33,048

97.30

Bottom 50%

<$33,048

2.7

The top 1% alone pays over 38% of all collected tax revenues. By the time you get to the top 25% they pay over 86% of all collected tax revenues. The top 50% of wage earners pay over 97% of all collected tax revenues. Keep in mind that while the word millionaire and billionaire are frequently thrown around when it comes to claims of the wealthy not paying their "fair share" of taxes that it is not only millionaires and billionaires that are in the sights of those wanting higher tax rates for the upper income workers. To use Obama's definition of the rich anyone earning $200,000.00 per year, $250,000.00 for a home with two incomes, is rich and should be taxed higher. But $200,000.00 or $250,000.00 per year income is not being rich or wealthy.

Again, you are incorrect. History has proven what you said to be inaccurate. For one, you have greatly misrepresented how long it takes for increased tax revenues to pour in after tax rates have been lowered. Your 10-years is incredibly inaccurate. You are also wrongly assuming there will always be a rate of inflation high enough that it would eat up any gains. That was not the case when President Harding was responsible for lowering taxes. That was not the case when President Kennedy was responsible for lowering taxes. It was not the case when President Reagan was responsible for lowering taxes and it was not the case when President Bush (Dubya) was responsible for lowering taxes.No, it has not been proven. Sure, if I cut taxes I might be bringing in more revenue 10 years from now but once you take into account population and inflation among other factors you really aren't bringing in any extra money.

I am sorry but your liberal propaganda cannot alter historical facts and it is incapable of determining future events.

The Bush tax cuts increased federal revenues 44% between 2003 and 2007.In fact, the Bush tax cuts have cost an estimated $2 TRILLION in one decade - there was no broadening of the base that took place. I see you invoke Reagan?

If someone wanted to state it differently the "Bush Tax Cuts", were, in in a way, the Bush tax increases. Actual revenues raised - tax dollars collected - increased consistently. If you took the 2003 revenues, and increased them annually at the average rate of the President Clinton years, the Bush tax increases collected $200 billion mote in revenue. It increased at a higher rate than the previous boom, and the wealthiest Americans by far paid the most.

Take a look at the Bush years and tax revenues collected and who paid them.

If you notice, in the bottom left of each graph you will see that the statistics came from the IRS itself and from the U.S. Treasury Department, not from some writer or politician with an agenda to further. Those are actual figures.

Frankly, if you knew anything about economics and tax policy as you seem to be claiming you'd know this. You know what else you'd know?

Maybe if you worked with accurate figures and not believe the leftist propaganda and revisionist history you might be better able to understand the results of taxation and as a result be correct rather than incorrect.

Johnny Retro

Well-Known Member

"work less, more pay"

"you worked harder than me in life, i deserve your money"

"you worked harder than me in life, i deserve your money"

Brick Top

New Member

No more tax code crap please. I didnt start a tax poll.

Yes or no, please.

You did ask; "Do you support the "Occupy" protests?" Didn't you? Did you only want yes or no answers or did you want to know why someone supports or does not support the Occupy Wall Street clown shoes? Their inane beliefs on taxation is largely why I do not, and will not, support them. I explained why they are clueless. Someone attempted to refute facts, so I pointed out that the facts remain facts regardless of all the leftist propaganda, and that is mainly why I cannot support the Occupy Wall Street buffoons.

Mike@420

Active Member

Im pro-capitalism, but we really need to take the money out of politics like that one guy said. So I partially agree with them. But.. Since the Occupants seem to be anti-capitalism, I wont support them.

Btw, in the past 2 months, Ive gotten and lost 2 jobs due to my own stupidity, and have received a few offers that ive turned down. Jobs are out there, people just need to do them. Besides what i just mentioned, Ive interviewed for quite a few other jobs too, and ive only been sending out resumes for 2 months.

Btw, in the past 2 months, Ive gotten and lost 2 jobs due to my own stupidity, and have received a few offers that ive turned down. Jobs are out there, people just need to do them. Besides what i just mentioned, Ive interviewed for quite a few other jobs too, and ive only been sending out resumes for 2 months.

Tales

Active Member

Simply trying to keep the thread on track. I am not discounting anyone's opinions.You did ask; "Do you support the "Occupy" protests?" Didn't you? Did you only want yes or no answers or did you want to know why someone supports or does not support the Occupy Wall Street clown shoes? Their inane beliefs on taxation is largely why I do not, and will not, support them. I explained why they are clueless. Someone attempted to refute facts, so I pointed out that the facts remain facts regardless of all the leftist propaganda, and that is mainly why I cannot support the Occupy Wall Street buffoons.

Yes or no is all I was looking for, but some comments are to be expected.

UncleBuck

Well-Known Member

makes sense, seeing as how the bottom 50% make about 1% of the income.The top 50% of wage earners pay over 97% of all collected tax revenues.

damn pesky facts, interfering with those damn annoying copy and pastes.

If you dont support i would have to say you are clueless.

First of all anyone who has an issue with people getting out and practicing democracy -FOR ANY REASON- is a communist (or other evil branding, like maybe socialist)

DEMOCRACY IS NOT TICKING A BOX IN A BOOTH AT YOUR LOCAL HIGH SCHOOL EVERY 4 YEARS

B. There are 2 common themes both of which coincide with each other. First one is end the Fed and corporate influence in Washington. Return the power to the people as right now they have none whatsoever. Second is an outcry of the overall corporatization of every fiber of our existence.

Look, this country wasnt created by people sitting around cleaning their guns while they watch Monday night football. It was however taken over by a coup because everyone is sitting around cleaning their guns watching Monday night football. The country has been stolen, and it was stolen in 1913. Thanks to the internet people are just starting to realize that en masse and this is the result.

First of all anyone who has an issue with people getting out and practicing democracy -FOR ANY REASON- is a communist (or other evil branding, like maybe socialist)

DEMOCRACY IS NOT TICKING A BOX IN A BOOTH AT YOUR LOCAL HIGH SCHOOL EVERY 4 YEARS

B. There are 2 common themes both of which coincide with each other. First one is end the Fed and corporate influence in Washington. Return the power to the people as right now they have none whatsoever. Second is an outcry of the overall corporatization of every fiber of our existence.

Look, this country wasnt created by people sitting around cleaning their guns while they watch Monday night football. It was however taken over by a coup because everyone is sitting around cleaning their guns watching Monday night football. The country has been stolen, and it was stolen in 1913. Thanks to the internet people are just starting to realize that en masse and this is the result.