PJ Diaz

Well-Known Member

Third time's a charm?Isn't this something like the third time that they've banned crypto this year?

Third time's a charm?Isn't this something like the third time that they've banned crypto this year?

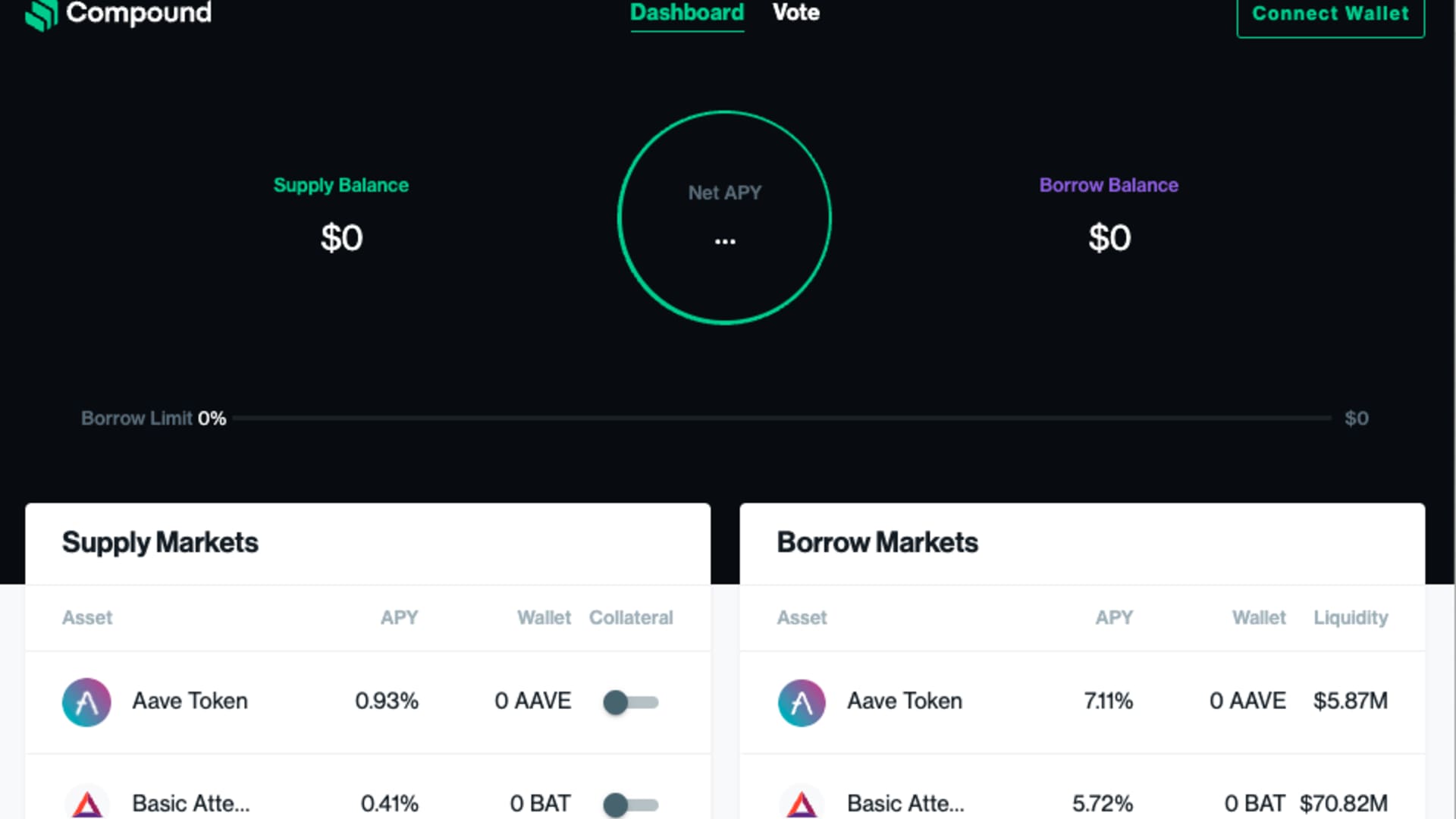

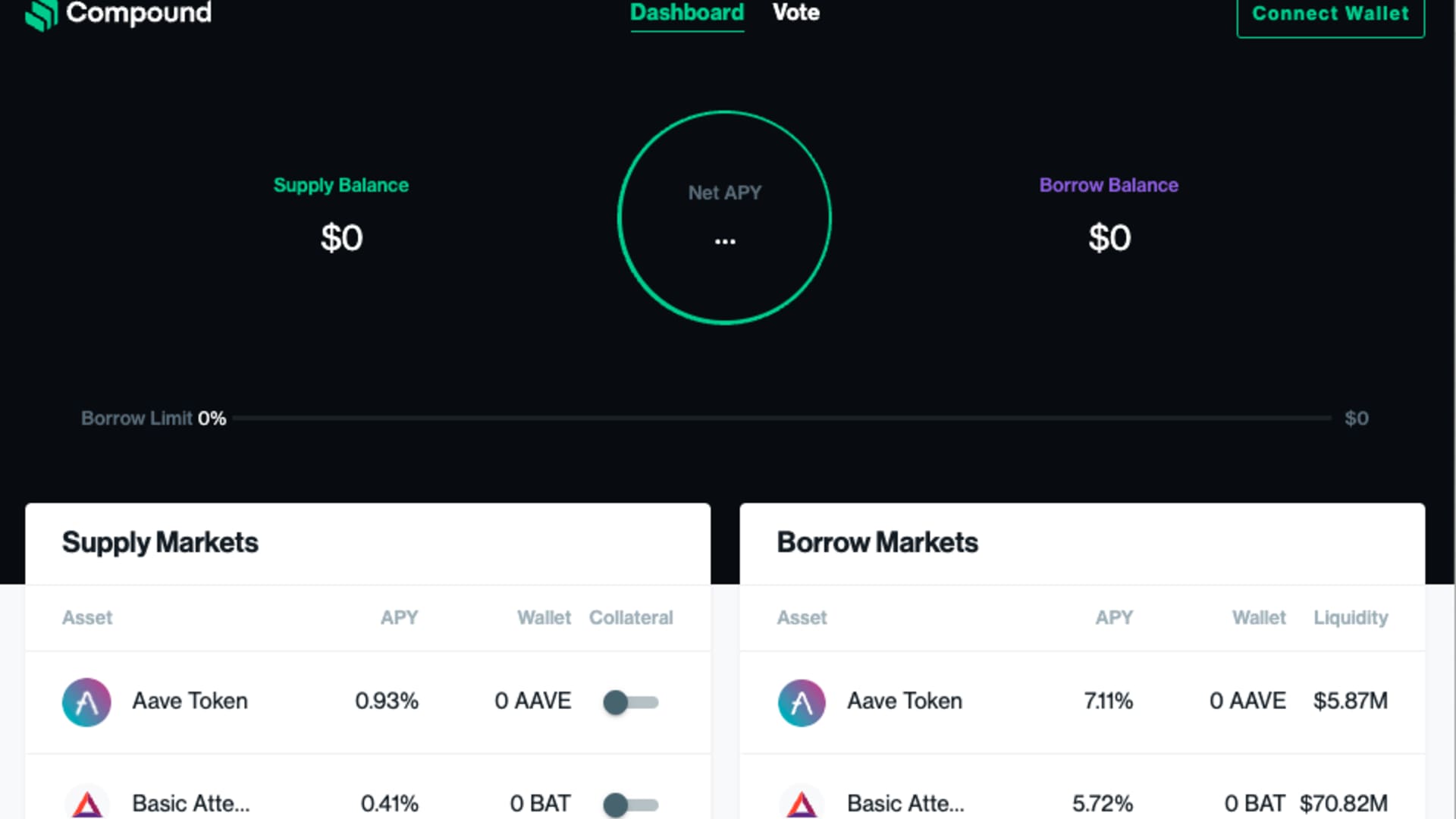

DeFi bug accidentally gives $90 million to users, founder begs them to return it

About $90 million went out in error to users of Compound, a decentralized-finance staking protocol. The founder is begging users to return the tokens.www.cnbc.com

27cents on the dog, too bad, but it should be 40 now instead of 22.Doge is back up! I bought back in last week at 27c, I wonder how high it's going to ride this go.

The 3commas bot is working well, 200$ profit over the past month or two using 1500$.

My buddy was saying something about amazon maybe using amp so I'm going to put some onto that and have a bot scalp it if it goes up.

One thing that's nice about crypto between 5-10 cents is if I fluctuates 1 penny that is around 10%. I've learned alot since starting this thread the biggest thing is don't be greedy, take profits when thing seem too good to be true and don't just wait because it will drop

A few coins I want to hold onto though are xlm, xrp, doge, amp , and ethereum.

A shit coin I'm going to sell profits on the way up on is NAFTY. It's been having some really nice gains.

What have yall been interested in the most? What do you think will stick around ?

This just in..I'm sure it instilled confidence in El Salvador that the day they officially adopt it as a legitimate currency it drops over 10%. I think it's a very bad idea for people in impoverished nations to fully adopt it as a currency. It's too volatile and the poorest are going to be the ones that lose the most.

This just in..

"El Salvador government spends $4,672 in electricity to mine $269 in bitcoins"

Gobierno gasta $4,672 para minar solo $269 en bitcoins | Noticias de El Salvador

Tras el anuncio hecho por el presidente Nayib Bukele sobre el primer minado de Bitcoin con energía geotérmica, del cual no dio mayores detalles sobre el costo que esto le representa al país, un experto hizo cálculos de cuánto ha gastado el gobierno en esa prueba. Carlos Martínez, catedrático de...www.elsalvador.com

This just in..

"El Salvador government spends $4,672 in electricity to mine $269 in bitcoins"

Gobierno gasta $4,672 para minar solo $269 en bitcoins | Noticias de El Salvador

Tras el anuncio hecho por el presidente Nayib Bukele sobre el primer minado de Bitcoin con energía geotérmica, del cual no dio mayores detalles sobre el costo que esto le representa al país, un experto hizo cálculos de cuánto ha gastado el gobierno en esa prueba. Carlos Martínez, catedrático de...www.elsalvador.com

I dunno, I think it's pretty cool. I think they are still getting their mining rigs all set up, and have dedicated a certain portion of the grid to mining, so that power consumption number may not really be actual consumption yet. I like the idea that they are using volcanic activity to produce power, so it's basically free renewable energy. It may only be a "rookie move" because no one has done it yet.They're so rookie. They're just using a mining pool like any of us could. What a joke. This guy is wasting his countries money and putting the personal finances of its citizens at risk. I don't understand what they're trying to do.

"The president published last Friday on his Twitter account an image that indicated an "account balance" with a "pending payment" for 0.00483976 bitcoin and with a "pending (estimated) mining" of 0.00599179 bitcoin to total 0.01083155 bitcoin."

Quoting first post.for fun , I put 100$ in dogecoin

I've never invested in anything

So investing in stocks is not a gamble ? I see what you're saying but I think the two words are very similar when talking about money. Investing in a crypto to me is like investing in gold except that crypto in non tangibleQuoting first post.

Anything related to currencies ("crypto" or otherwise) is not "investing", it's "gambling".

I agree. I mean I just lost $2k in stock value last week. I'm sure it will come back, but I was thinking about cashing out. Shoulda done it a couple weeks earlier.So investing in stocks is not a gamble ? I see what you're saying but I think the two words are very similar when talking about money. Investing in a crypto to me is like investing in gold except that crypto in non tangible

You could call it more of a gamble than a solid investment but you could be wrong

. Digital currency has already proven its utility and value in many ways and has a lot of growth potential still. I believe we are seeing history

You do not "invest" in stocks. You put your money in stocks. That is "saving", not "investing". It can also be seen as gambling, of course.So investing in stocks is not a gamble ?

You don't "invest" in gold, you put your money in gold, which is just another way of saving the money. A rather foolish way, because gold does not bear interest (neither do cryptocurrencies).Investing in a crypto to me is like investing in gold

There are dozens of platforms that offer interest on cryptocurrencies, almost all of them have much higher interest rates than a high yield savings account, which usually dont even offer anything over 0.5% apy. Many crypto exchanges offer 5-10%APY on BTC and other cryptocurrencies.A rather foolish way, because gold does not bear interest (neither do cryptocurrencies).

Good luck with your money, and future financial endeavours.Many crypto exchanges offer 5-10%APY on BTC and other cryptocurrencies.

Crypto is the future of finance, whether you like it or not. Mainstream onboarding is already underway.

LOL. People don't put their money in stocks or a 401k for "saving", that's what savings accounts are for. People invest in stocks and 401k in anticipation of an increased financial return. It is surely gambling just as much as crypto is, and you can definitely lose your "savings' by investing in stocks. Don't fool yourself.You do not "invest" in stocks. You put your money in stocks. That is "saving", not "investing". It can also be seen as gambling, of course.

You don't "invest" in gold, you put your money in gold, which is just another way of saving the money. A rather foolish way, because gold does not bear interest (neither do cryptocurrencies).

If I wanted to gamble I would pick something other than cryptocurrencies.

Right now the only reason to put any money in crypto is if you want to make shady transactions or have a legitimate reason to (thinly) veil your payment activities.

A broad investment in stocks historically gives you a net-net (i.e. after everything) financial return of ~5% annually, over a long enough period of time (say, 20-30 years). That's your share of the cake, not more, and all the usual caveats apply ("past results are not to be taken as a prediction of future returns, yada yada").People invest in stocks and 401k in anticipation of an increased financial return. It is surely gambling just as much as crypto is, and you can definitely lose your "savings' by investing in stocks. Don't fool yourself.

Sure guy..A broad investment in stocks historically gives you a net-net (i.e. after everything) financial return of ~5% annually, over a long enough period of time (say, 20-30 years). That's your share of the cake, not more, and all the usual caveats apply ("past results are not to be taken as a prediction of future returns, yada yada").

I can recommend the book "Pragmatic Capitalism" by Cullen Roche (I don't know if it's still in print, but it's fairly recent).