BarnBuster

Virtually Unknown Member

A Surprising Reason Your Health Care Costs More in Retirement

By ELIZABETH O'BRIEN, Money, July 10, 2019

Health care is one of retirees’ biggest expenses, but it’s not just because older people tend to access more medical services. Even if you never visit the doctor, your insurance bill will be higher in retirement than it was when you were working, according to a new analysis.

That’s because retirees pay a bigger share of their premiums under Medicare than they did under their employer’s health insurance. Employers generally subsidize around 75% of their employees’ health insurance premiums, leaving employees responsible for just a quarter of the monthly costs, according to HealthView Services, a Danvers, Mass.-based company that provides health care cost data to financial advisors.

In retirement, however, you’re responsible for 100% of your Medicare premiums. And that often comes as a surprise.

“We find that a lot of people believe Medicare is free,” says Ron Mastrogiovanni, CEO of HealthView Services and HealthyCapital.

The only part of Medicare that’s “free” for most beneficiaries is Part A premiums, but that’s only because you paid them while you’re still working through payroll taxes. Part A covers inpatient hospitalizations. Part B covers doctors’ visits and outpatient services, and the standard premium for people enrolling this year is $135.50 a month (high earners pay more). Part B premiums are deducted directly from your Social Security check — unless you haven’t yet claimed your benefits, in which case you pay them outright.

Many enrollees with Original Medicare choose to buy a Part D drug plan and a Medigap supplemental insurance plan as well. The national base premium for part D is $33.19 for 2019, although actual costs vary based on your exact plan and location. The cost for supplemental plans also varies based on plan type and location.

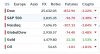

The upshot? A 64-year-old who pays $2,090.27 this year in premiums for an employer PPO plan will pay $3,701.98 annually next year on Medicare Part B, Part D and a Plan G supplement, according to the HealthView Services analysis. It assumes the beneficiary is on Original Medicare, not Medicare Advantage (also known as Part C) since the former more closely resembles a typical workplace plan.

The sooner you’re aware of this cost gap, the better you can prepare. A 50-year-old who invests $111,816 today and earns 6% returns will have enough to cover retirement health care expenses starting at age 65, including out-of-pocket costs (but excluding Part B premiums deducted from a Social Security check), according to HealthView Services. Or, instead of investing a lump sum, you could bump up the percentage of pay you’re putting into your 401(k) every month.

That way, you won’t have to skimp on coverage when the time comes. Some people get sticker shock when pricing supplement plans and decide to skip Medigap altogether, Mastrogiovanni says. Fast forward a decade or so, and they’ve accumulated more health concerns and want to buy coverage. But outside of a narrow window around your initial enrollment in Medicare, you can be charged more for supplemental coverage or even denied it outright based on your health status. So it often pays to buy a plan when you first enroll.

Great hobby.

Great hobby.